“The problem with socialism is that you eventually run out of other people’s money.” ― Margaret Thatcher

I read with horror the vision of nationalising the life insurance, banking and mining industries as outlined by Professor Chris Malikane, one of the new Finance Minister Malusi Gigaba’s advisers, in the Sunday Times. I cannot help feeling that it is meant to be a shot across the bow of SA Business Inc. in case it was seen not to support the more moderate narrative emanating from the “new” National Treasury. Propaganda can be a blunt, but an effective, tool. But it can also backfire.

I grew up in a country where everything was nationalised, circa communist Poland 1970s. Let me describe that nirvana. On a positive note, education and health care were free, and everyone had guaranteed employment, not according to skill, of course, but according to his or her affiliation to the Communist Party (sounds vaguely familiar?). Since everyone was employed at about the same salary, except for the Communist Party members, there was little reason to work hard. No one did. There was no incentive for shops to stock anything but generic domestically-produced basics. There were no imported goods as the country had no foreign exchange and neither did its population. There were luxury shops, but those were only open to Communist Party members who could pay in US dollars. There was no free media, nor freedom of movement. All farmers worked for collectives and had to sell their produce at regulated prices. Everyone lived in small apartments in concrete blocks which litter the countryside to this day. Housing was at a premium so generations of families lived together. No one had any savings as you could not invest freely. Poland did belong to a political and economic bloc comprising other communist countries and the USSR, aka BRICS of 1970s. What did the USSR do for Poland other than installing its puppet government? It stripped the country of all its raw resources, including coal and steel. And eventually, in the words of Margaret Thatcher, “other people’s money run out”. As political and economic isolation bit, Poland went bankrupt overnight. No more free education, health care or employment. As food disappeared from shop shelves, food stamps were handed out instead – but, as people soon discovered, you cannot eat paper. The mass exodus of refugees started soon after. Poland declared martial law to stem the outflow. As poverty and misery swelled the entire system collapsed under the weight of mass uprisings.

Professor Chris Malikane would do well to study the past – history tends to repeat itself.

But we do not need to look that far back in history. Nor do we need to look to another country such as Poland or Zimbabwe. Let’s look at our own domestic edifices to nationalisation, otherwise known as the state-owned enterprises. SABC, SAA, Eskom, Denel, Prasa – the list is a litany of financial mismanagement, poor governance, cronyism and corruption, unable to generate a profit and surviving on state guarantees in order to be able to borrow to live another day. What happens the day those state guarantees are judged as worthless? The extension of this “business” model to other industries is a recipe for national disaster.

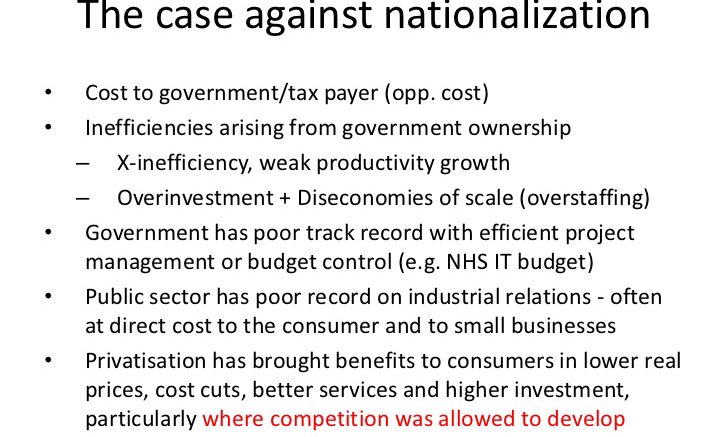

If there is one thing that history has proven is that nationalisation is not a sustainable way of running an economy. It is a fundamentally flawed model that redistributes wealth to a few at the expense of almost everyone else. The wealthy flee, as do skills and job-creating corporates. Foreign capital leaves. Political oppression increases in the face of popular discontent. Political and economic sanctions are imposed. The poor get poorer. The economy collapses. And eventually the masses rise up and overturn the system.

As to our friends, the BRIC nations, I would not hold my breath. Brazil is going through its own political upheaval and a recession, Russia is barely sustaining its economy under the weight of political sanctions and low oil prices, and China’s economy is slowing down while the country is deliberately relaxing its “nationalised industry” model to allow capitalism to flourish. Russia’s interest in Africa? Flogging their nuclear projects. China’s interest in Africa? Securing natural resources for the future of China. Oh, and they managed to kill our steel industry while they were at it. That leaves India which has shown scant interest in Africa as it tries to eradicate its own institutionalised corruption. None of these are likely to invest in South Africa, and certainly not with a threat of nationalisation hanging over their heads.

South Africa’s debt is already rated as “junk”. The nationalisation narrative is hardly helpful at a time when the new Finance Minister will already struggle to convince a highly skeptical international investment community that we are still worthy of their interest. It will be yet another embarrassing item to add to his growing list of the unexplainables, alongside the cost of the nuclear deal, the unsigned FICA Bill, the political gamesmanship and the collapsing governance of state-owned enterprises. Good luck, Minister Gigaba. You have taken on a Herculean task.

For those in the ANC who still do not get it, let me describe it through the crib-notes I made while studying economics at university:

Corporate sector:

no foreign investment or loans = no expansion of industry = no job creation or wage increases = no spending on goods and services = no tax revenue (individual, corporate, VAT)

Public sector:

no foreign investment or loans + no tax revenue = no money for:

– delivery of basic services, including education, health care, water and electricity

– wage increases for the public sector

– welfare benefits for the poor

– delivery on political promises

= mass uprisings

The same applies whether the money dries up or, in a more diluted form, if the cost of borrowing increases. The “junk” status imposed on the debt of our government, our life insurance companies, our banks and our state-owned enterprises means that we are already living through my crib-notes. Why don’t we add more fuel to the fire by talking about nationalisation? In for a penny, in for a pound. DM

https://www.dailymaverick.co.za/opinionista/2017-04-17-lets-talk-about-nationalisation-of-industry/?utm_term=Autofeed&utm_campaign=Echobox&utm_medium=Social&utm_source=Facebook#link_time=1492419671